On 8 Sep., a webinar with the topic of Impact of Cancelation of Corn Storage

Policy in China was successfully held by CCM. And now, we are here to share all

the details of the webinar to all the visitors.

Six parts was shared in our webinar in the following

orders. Brief introduction on corn temporary storage policy

-

Problems caused by corn temporary storage policy

-

Policies to deal with the problems

-

Impact of the policy cancellation on crops’ planting areas

-

Impact on downstream corn processing enterprises and products

-

Expectation

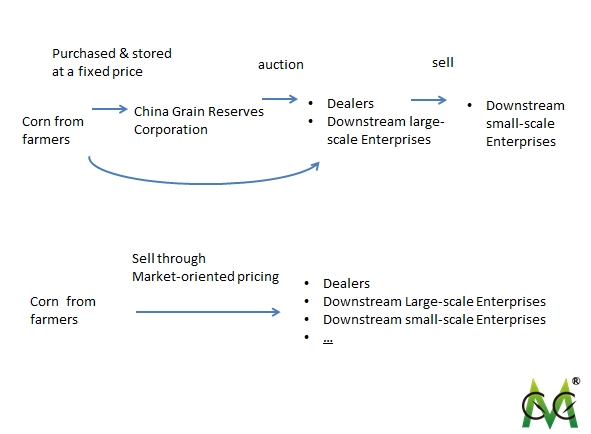

What

exactly is corn temporary storage policy in China?

The policy started in 2008 and ended in 2016.

The Chinese government assigned China Grain

Reserves Corporation to purchase corn from farmers in Northeast China, which

includes Liaoning Province, Jilin Province, Heilongjiang Province, and Inner

Mongolia Autonomous Region. The corn would be purchased at a fixed price. Then China

Grain Reserves Corporation would store the corn temporarily.

In fact, in the beginning, the policy aimed

to help the farmers to buy their corns because the international corn prices

fell a lot in 2008. It is believed that it is a strategy from the Chinese government

to stabilize the farmers.

In the passing nine years, Chinese

government shifted the aim for food security in China by encouraging farmers to

cultivate more corn.

Let’s have a look about the procedures on

how the policy went in the related provinces and region in China.

Some corn would be purchased by China Grain

Reserves Corporation.

The corn would by purchased at a fixed

price, and this price would be usually higher the corn prices directly sold to

the downstream market. Because if the purchased prices was lower, the farmers

would not be willing to sell their corn to China Grain Reserves Corporation.

Then the purchased corn would be on an auction

held by China Grain Reserves Corporation and the dealers and downstream

large-scale enterprises would bid on the corn. And some dealers and enterprises

would sell some corn to some small-scale downstream enterprises.

Also, some corn would be directly sold to

the dealers and downstream corn processing enterprises.

This is how the policy went before it got

canceled.

So what happens after the policy is

canceled? Here is what happens.

Corn would not be purchased and stored. The

corn would be more directly sold to the dealers, downstream large-scale enterprises

and small-scale enterprises, which includes the state-owned enterprises of

corn, private corn enterprises and individual corn enterprises. The most

important change would be the corn prices. There is no fix price on corn any

more. The corn price would be based on the market total.

So why the policy would get canceled now?

Because it has caused three serious

problems in corn.

Problem

one: there is too much corn stock in China.

Before the cancellation, there were over

250 million tonnes of corn stock in China.

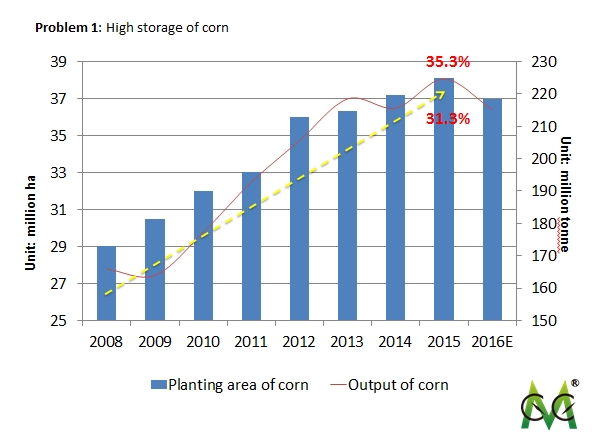

Here are some graphs to illustrate the problems.

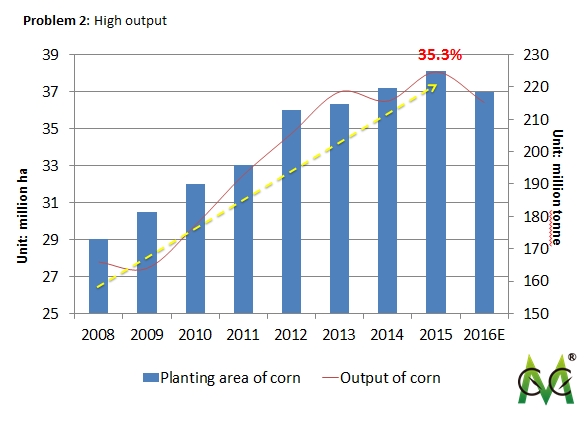

Both the planting areas and output showed an upward trend in the past eight

years.

The planting areas of corn were up 31.3% in

2015 compared to that in 2008 and the output of corn was up 35.3% in 2015 than

that in 2008.

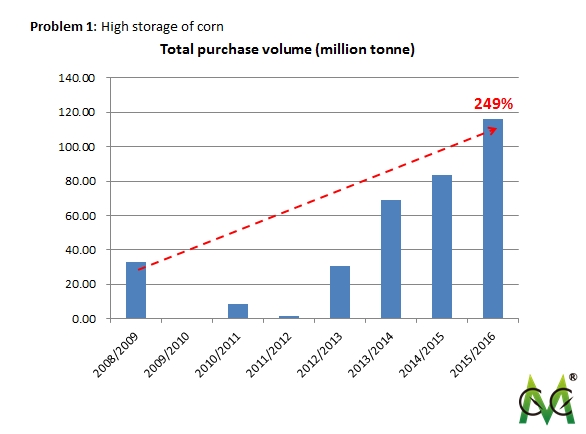

Here is another graph to show the corn

purchase volume from 2008 to 2016. It is also an upward trend. The purchase volume

in 2016 was up 249% compared to that in 2009.

It is actually a vicious circle for the

high corn stock in China.

The corn temporary storage policy had

stabilized the corn price in China at a high price in order to fight against

the price offers by other enterprises. With the high prices, the farmers would

keep planting corn because the government would purchase the corn at a high

price no matter what happens, which caused high output of corn in China then

high corn stock. In the next year, same things happened again.

Problem

two: High output

of corn in China

The output of corn in China kept

increasing. It was up 35.3% in 2015 than that in 2008.

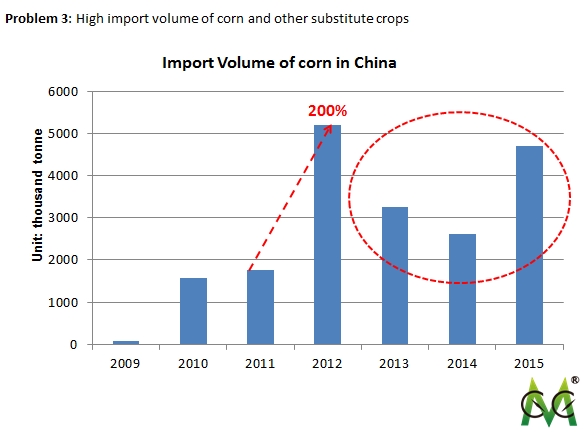

Though the corn output was super high in

China, the import volume of corn still kept increasing in the past few years!

It is such a contradictory and it comes the third problem: high import volume

of corn.

Problem

3: High import volume of corn and other substitute crops

In fact, the high corn price in China and

the lower international corn price pushed the import volume of corn to rise in

2012, up almost 200% compared to that in 2011. And in the following years, the

import volumes of corn stayed high.

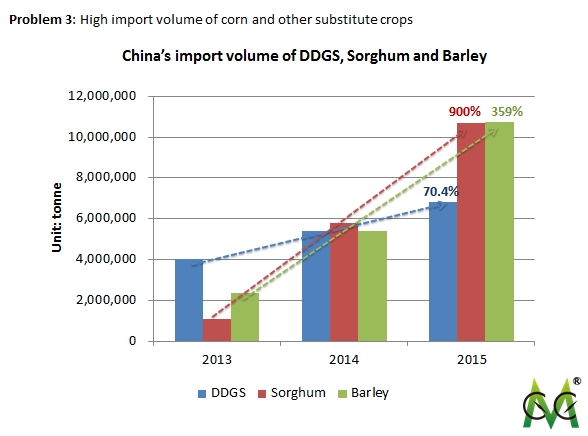

Not only the import volumes of corn

increased, so did corns substitute crops, like DDGS, Sorghum and Barley. You

could see from the graph that all import volumes showed an upward trend in

2013-2015. The import volumes of DDGS was

up 70.4% in 2015 compared to that in 2014; barley, even 900% up and sorghum,

359% increased.

Policies

to tackle the over stock of corn

So, with these three serious problems

caused by the corn temporary storage policy, besides cancelling the policy, the

government has also released some other policies to tackles the over stock of

corn.

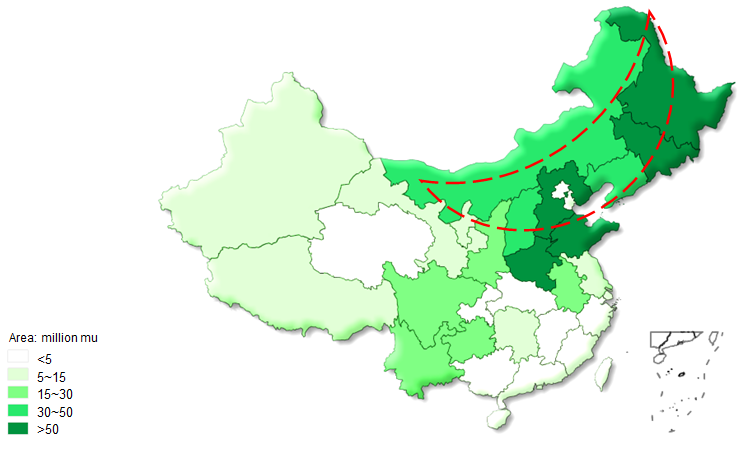

In the very beginning, the Chinese government

has released Structure Adjustment Plan on

Corn Planting Area in the ‘Sickle-Shaped Region’ (2016-2020).

Most of the lands are located in Northeast

China and it looks like a sickle.

It aims to reduce the total area of land

used for corn cultivation in “sickle-shaped” region by 3.33 million ha over the

next five years in 2020.

The policy is reducing the over stock of

corn from its origin – the planting areas.

And it also aims to cut down the amount of

land used for producing grain corn - corn that can be used for food production

- and convert this land to producing silage corn - corn used only to produce

animal feed.

The policy is reducing the over stock of

corn from its structure.

Later, the Chinese government published National Adjustment Plan of Crop Farming

Structure, according to the policy, the farmers should conduct rotation of

corn with soybean, potato and silage corn.

This is another policy to reduce the over

stock of corn from its structure.

Just in last month, (9 Aug., 2016), China's

Ministry of Finance and State Administration of Taxation issued a notice that

since 1 Sept., 2016, the export tax rebate rate of 10 corn products including

corn starch and corn alcohol will be restored to 13%.

It is known that the rebate rate adjustment

is an important measure to respond to the de-stocking of corn in China.

The policy is to reduce the over stock of

corn from its downstream consumption.

The cancellation of this policy might cause

that the corn price will be decided by market demand and supply, which may

affect the benefits of farmers. However, the government will offer some

subsidies for corn producers.

In order to protect the farmers’ benefit, recently,

the first batch of subsidy fund, up to USD4.49 billion, has been in place. With

USD988 million in Inner Mongolia Autonomous Region, USD688 million in Liaoning

Province, USD1.09 billion in Jilin Province and USD1.736 billion in Heilongjiang

Province.

Possible

change of crops’ planting areas in China

The government has decided to cut the corn

planting area in a large scale, but we think in short term, the planting area

of corn may decrease slowly. There are four main reasons:

At the beginning, some farmers have already

purchased corn seeds earlier, which is unrealistic for them to abandon these

seeds. According to our research, the cost of seed occupies about 12% of the

total cost in planting corn.

Besides, the economic benefits of other

crops are also low. For example, in Nehe, Heilongjiang province in 2015, the

economic benefit of corn is about 300 dollars more than that of soybean in

every hectare.

What’s more, we need to take the

difficulties of changing crops into consideration, because each crop has its

own specialty. And they require different weather conditions, soil

characteristic, capital input and so on.

In the end, some farmers still have

expectations for the policy. Before the official cancellation of the temporary

purchase and storage of corn policy, they expected the state might keep this

policy for one or two more years. Even after the cancellation, they also hope

for the high subsidy for it.

However, from the perspective of long term,

we think the planting areas of other crops are supposed to increase. In

particular, some planting areas, which are not corn-planting dominant region,

could be used for other crops. And the following three ones will be the main

alternatives---Soybean, potato and silage corn.

Why

these three are the main choices?

Soybean

In 2015, China imported more than 80

million tonnes of soybean, accounting for more than 80% of total domestic

consumption. For the state, such huge of import volume in soybean reflects the

imbalance of the agricultural structure, more severely, threating the state’s

food security.

In order to ease the situation, the

government issued the Guiding Opinions on Promoting the Development of Soybean

Planting this year.

China’s Ministry of Agriculture suggests

that up to 2020, the soybean planting area should reach 9.33 million ha in

China, a 2.67 million-ha increase compared with that at present.

So the planting area of soybean is expected

to increase largely in long term.

Potato

Another main change may probably fall on

potato.

As we know, in 2015, China has set potato

as the 4th staple food.

And according to the 13th Five-year Plan

for the Potato Industry (2016-2020), the goal for planting area of potato is

more than 6.67 million ha.

As far as potato is concerned, it enjoys

the features of high nutrition value and good adaptiveness for planting

environment. Therefore, we can expect the growth of potato in China.

Silage

corn

Besides, the share of silage corn is

supposed to grow.

In 2014, only 4.3% of the total corn

produced in China was silage corn, which is an important kind of feed for

livestock.

Chinese government also encouraged more

transformation from grain corn to silage corn in the Structure Adjustment Plan

on Corn Planting Area in the ‘Sickle-Shaped Region’ (2016-2020) and National

Adjustment Plan of Crop Farming Structure (2016-2020)

According to the document, by 2020, the

total planting area of silage corn in China should be 1.67 million ha.

So it can be expected that a large amount

of land will also be converted from producing grain corn to growing silage

corn.

Impact

on downstream corn processing enterprises and products

CCM thinks that the decreasing price of raw

materials, which are related to corn, is the main change for the downstream

enterprises and products.

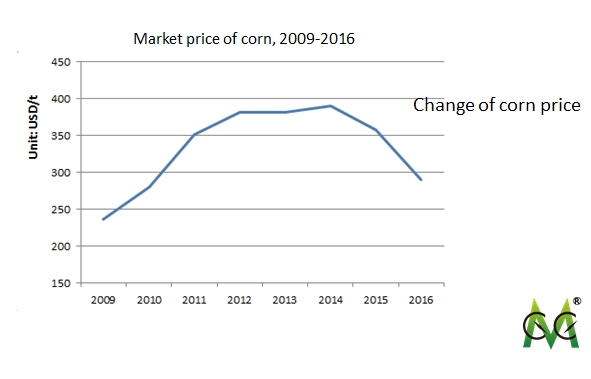

Since the implementation of temporary

purchase and storage of corn policy in 2008, the price of corn increased year

by year, with the highest average price reaching about 390 dollars per tonne in

2014.

On one hand, we can imagine that how

difficult it is for most corn downstream enterprises. On the other hand, the

state stock volume of corn increased largely. Up to the moment this policy was

cancelled, there were more than 250 million tonnes of corn in stock. In a word,

China’s corn was in an awkward situation of high output, high inventory, high

import volume and high price.

Since July 2015, the corn price has

decreased largely, arriving at 270 dollars per tonne or so at present.

Subsequently, the cost of raw materials for corn downstream enterprises drops.

So naturally, the operating cost of some companies and the price of some

products may bring down.

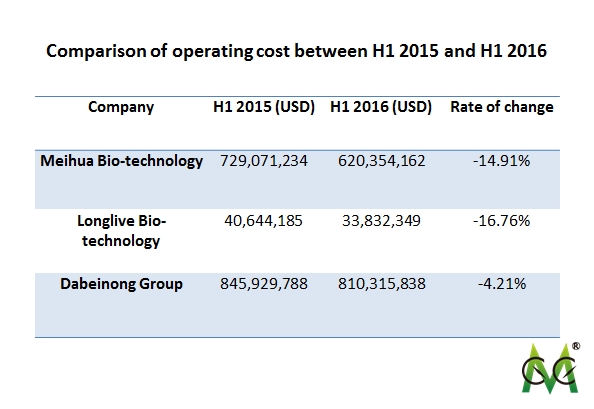

For example, the following listed

companies, which take corn as their main raw materials, enjoyed lower operating

cost in H1 2016 compared with that in H1 2015 thanks to the reduced price of

corn.

We can see that the cost of Meihua

Bio-technology, Long-live Bio-technology and Dabeinong Group in H1 2016 reduced

by 14.91%, 16.76% and 4.21%, respectively.

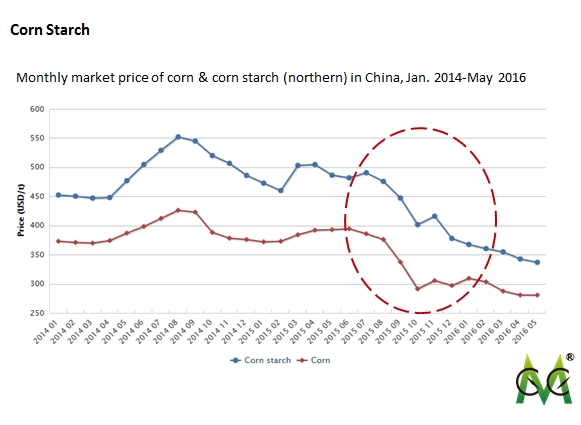

In the following, let’s see the price

trends of some deep-processing products.

From this chart, it’s easy to conclude that

the price of corn starch is relative highly with that of corn. As the corn

price dropped a lot from July 2015, the moving trend of corn starch is similar

to it.

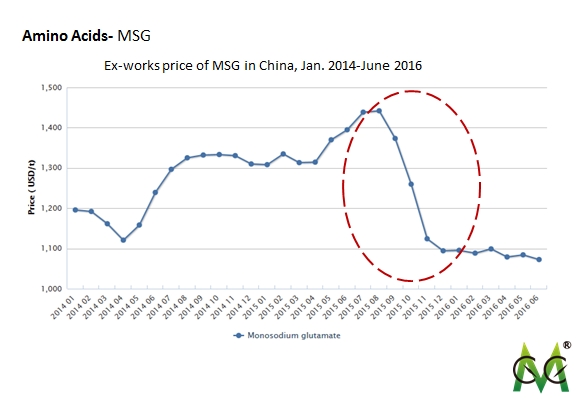

Next, we focus on the monosodium glutamate

(MSG). Within half a year, the price of MSG went down from around 1450 dollars

per tonne in July 2015 to 1100 dollars per tonne or so in December 2015, a drop

of 24.14%.

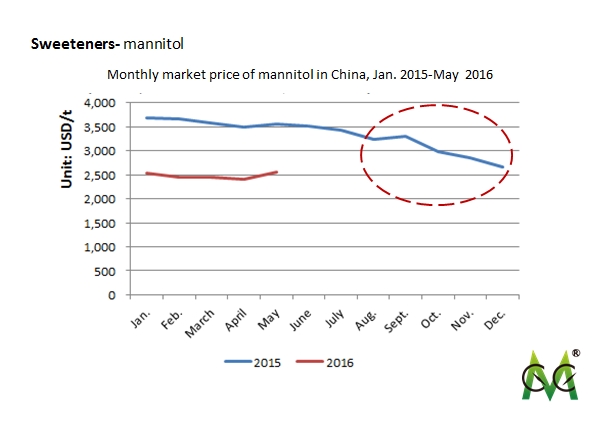

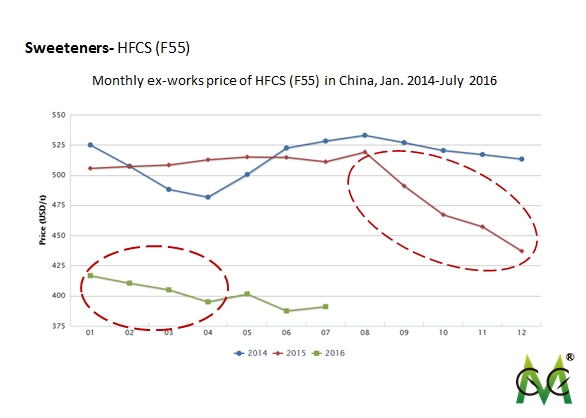

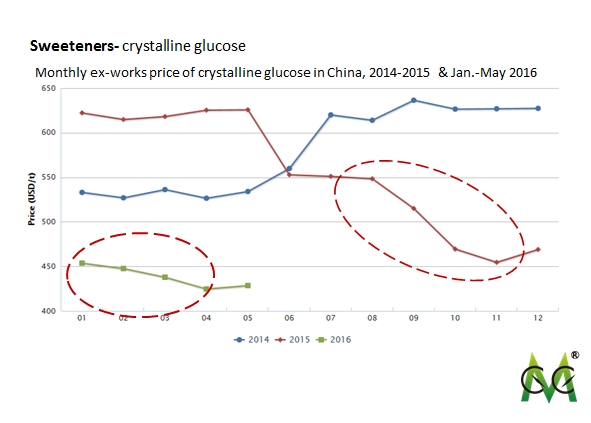

Then, let’s observe the prices of several

sweeteners.

The price of mannitol decreased from about

3500 dollars per tonne in July 2015 to 2500 dollars per tonne in January 2016,

down by more than 28.57% in this period.

What’s more, the price of HFCS (F55)

experienced a similar trend, down from 510 dollars per tonne or so in August

2015 to about 400 dollars per tonne in April 2016, a drop of 21.57%.

The price of crystalline glucose declined

from 550 dollars per tonne in August 2015 to about 425 dollars per tonne in

April 2016, down by 22.73%.

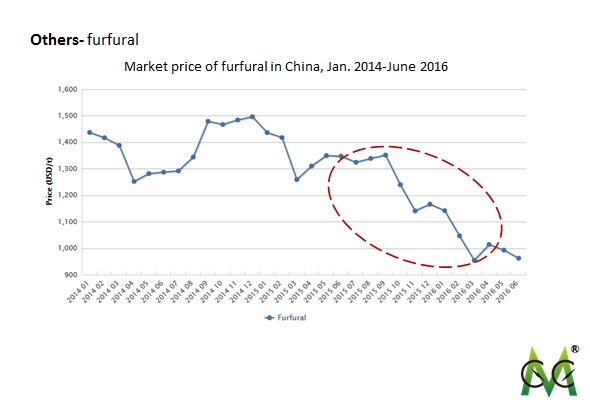

And the price of furfural fell from about

1350 dollars per tonne in October 2015 to 950 dollars per tonne in March 2016,

down by 29.63%.

From above examples, we can see the effects

of the cancellation of this policy. Further, what can we expect for the future?

Expectation

Here, we have listed three main

expectations:

1. The price of corn may continue

to decrease with the auction of more stocked corn and the arrival of new corn.

2. China’s import volume of corn

and its substitutes are expected to go down. (Actually, China’s import volume

of corn has decreased by 97.38% YoY in July)

3. Some corn downstream

enterprises may get benefits from the reduced price of raw materials.

* All

the data are sourced from China Customs, China’s Ministry of Agriculture,

annual reports of listed companies and CCM.

If you are interested in our PPT of the

webinar, please email at econtact@cnchemicals.com and our colleague would send you the PPT as soon as possible.

About CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.